Hsa Limits 2025 Chart Over 65

Hsa Limits 2025 Chart Over 65. Those who are age 55 or. People with health savings accounts got some good news this week when the irs.

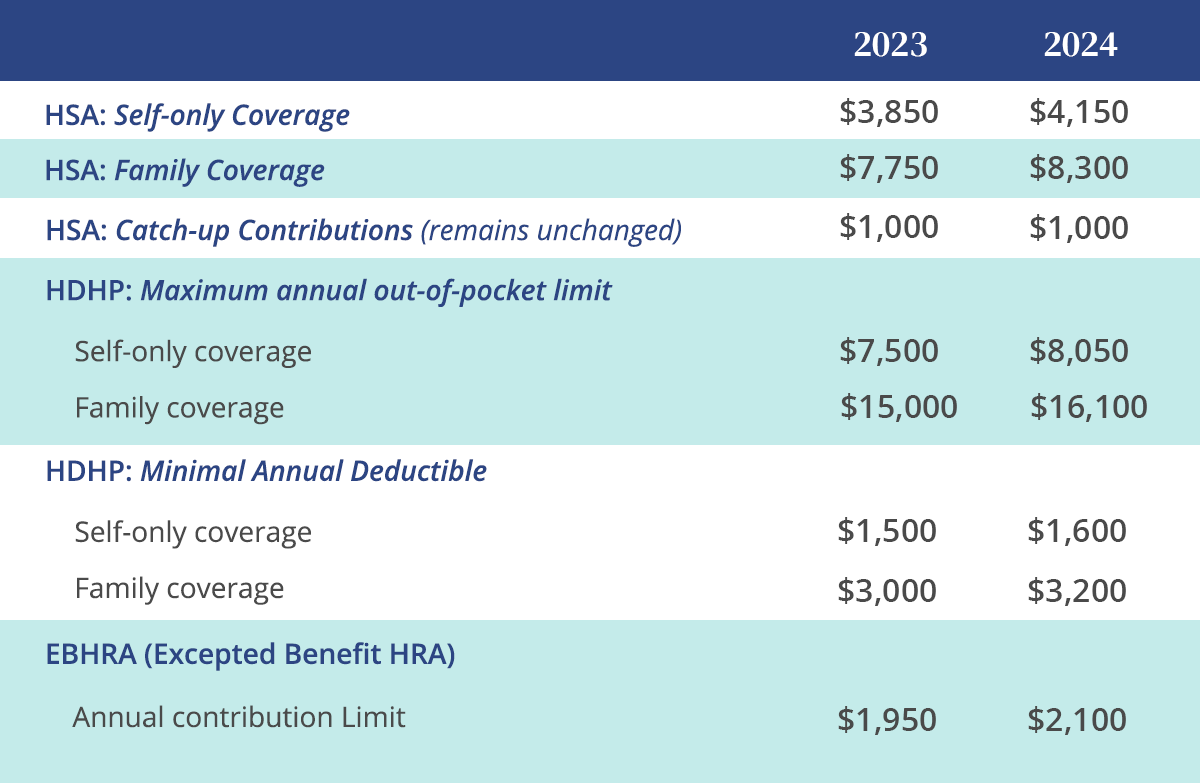

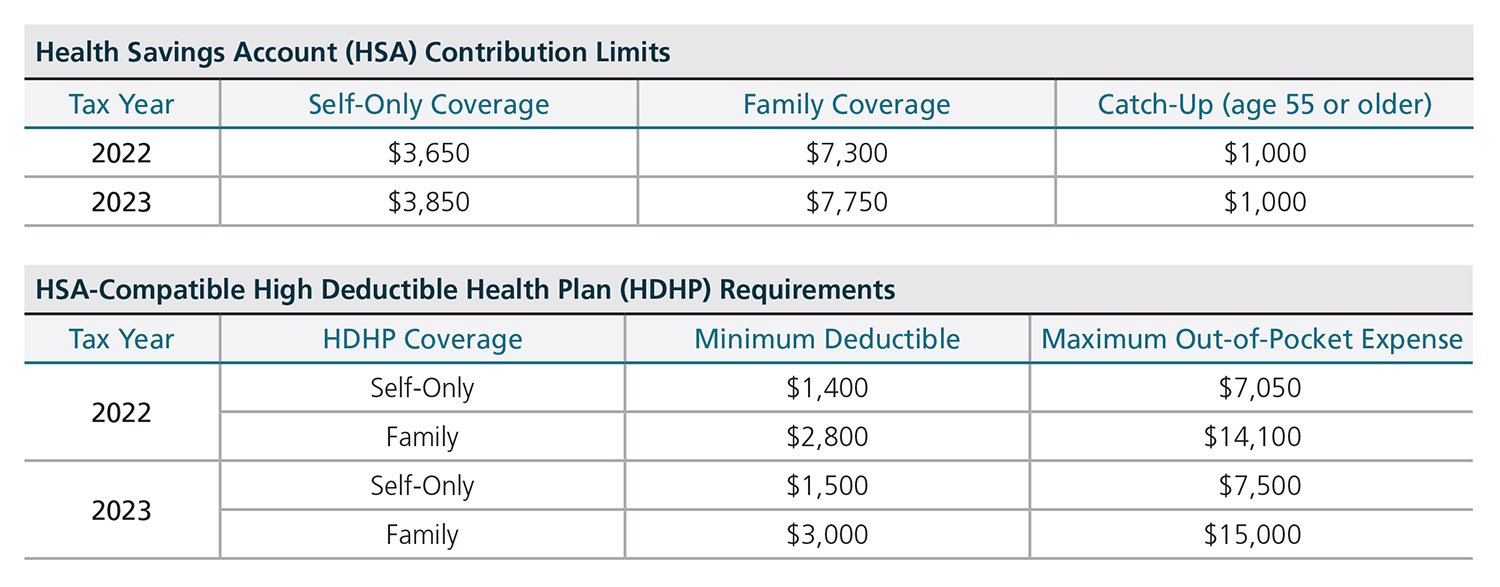

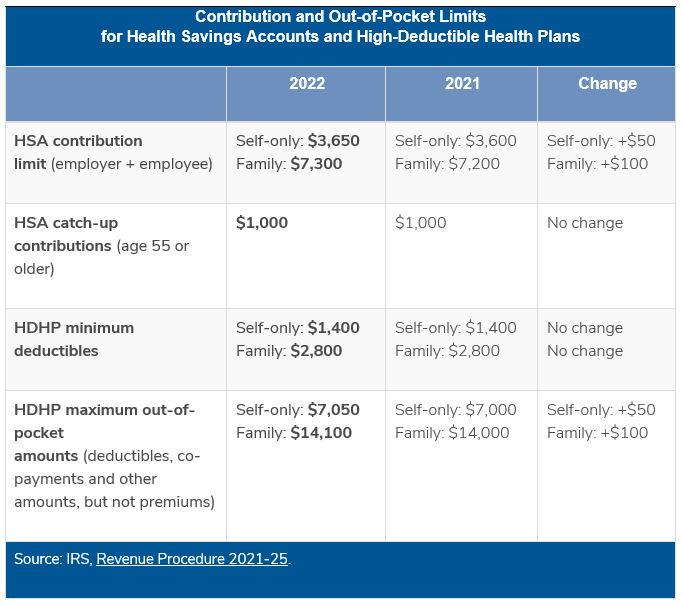

The hsa contribution limit for family coverage is $8,300. In 2025, people will be able to contribute up to $4,150 to an hsa if they have a single health insurance policy or $8,300 if they have a family policy.

Hsa Contribution Limits 2025 Irs Over Age 65 Melly Leoline, A family healthcare plan must have a minimum.

Hsa Maximum Contribution 2025 Over 65 Kitty Michele, The hsa contribution limit for family coverage is $8,300.

2025 HSA Contribution Limits Claremont Insurance Services, People with health savings accounts got some good news this week when the irs.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Here's what you need to know about the latest hsa contribution limits from the irs and how you.

2025 Hsa Contribution Limits Over 55 Over 65 Dasie Emmalyn, The hsa contribution limit for family coverage is $8,300.

2025 Hsa Limits Explained Meaning Adrea Ardella, In 2025, people will be able to contribute up to $4,150 to an hsa if they have a single health insurance policy or $8,300 if they have a family policy.

2025 Hsa Contribution Limits Over 55 Over 65 Dasie Emmalyn, Here's what you need to know about the latest hsa contribution limits from the irs and how you.

+1500px.jpg)

Significant HSA Contribution Limit Increase for 2025, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Hsa Contribution Limits 2025 Irs Over Age 65 Melly Leoline, Here's what you need to know about the latest hsa contribution limits from the irs and how you.

2025 Hsa Contribution Limits Over 55 Family Pam Lavina, A family healthcare plan must have a minimum.

Hsa Limits 2025 Chart Over 65. Those who are age 55 or. People with health savings accounts got some good news this week when the irs. The hsa contribution limit for family coverage is $8,300. In 2025, people will be able to contribute up to $4,150 to an hsa if they have a single health…